The dream of owning a home is something most Australians aspire to. It’s a symbol of stability and security, and an incredible accomplishment no matter how old you are when it happens. But while it’s a fundamental part of the Great Australian Dream, the cost of living has made it harder than ever to get a foot on the property ladder.

That’s why it’s so exciting for aspiring homeowners to learn that Queensland doubled its First Home Owner Grant (FHOG) to $30,000. Here’s what you need to know.

Introducing the First Home Owner Grant QLD

Queensland’s FHOG is a government initiative that’s been helping eligible first home buyers in their quest to secure their own home. The doubling of the grant to $30,000 until mid-2026 is a huge step forward in reducing the financial pressures facing so many would-be home buyers.

The Queensland Government stated there’s no denying just how important this increase really is and underlining its purpose as a vital cost-of-living measure.

Key Details of the QLD First Home Owner Grant Increase

This increase to the home owners grant amount is effective immediately for new builds valued up to $750,000. It applies to a wide range of housing types, including houses, units, duplexes, townhouses, modular homes and even granny flats. The purpose of this financial boost aims to address the challenges facing those who need a little financial help to enter the property market.

This announcement comes off the back of recent statistics that show Queensland's home-ownership rates among young adults have dropped off significantly. While many established home owners have the capacity to buy an investment property, it’s the younger generation who are struggling to find an established home within their budget. In 1971, around 53% of Queenslanders aged 25–29 owned their homes, whereas only 35% were able to do so in 2021. The biggest factors contributing to this decline include surging property prices and increased cost-of-living pressures.

How First-Time Homebuyers Can Benefit

With access to $30,000, the financial burden for first-time home buyers will hopefully ease significantly. Whether it’s to build a new house on vacant land or for any other eligible transactions, aspiring first home owners now have greater access to the property market.

The Queensland Government estimates that the increased grant will help around 12,000 first home buyers to step onto the property ladder by 30 June 2026. This initiative wants to bolster the confidence of potential buyers and empower them to overcome recent financial barriers like consecutive interest-rate rises.

Eligibility Criteria

To be eligible for the First Home Owner Grant, you will need to pass certain criteria, including but not limited to:

- Being a first-time homebuyer.

- Purchasing or building a brand new home at or below $750,000.

- Intending to occupy the property as a principal place of residence (i.e. not as an investment or on someone else’s behalf).

- Being an Australian citizen or a permanent resident.

For more detailed information on how you can meet these eligibility prerequisites, seek advice from government resources or speak to our financial specialists at MyChoice Home Loans.

MyChoice Home Loans

MyChoice Home Loans removes the stress of finding your own finance – we make securing your dream home, easy, enjoyable, and uncomplicated.

As construction home loan specialists, the team at MyChoice Home Loans will partner with you along every step of the building journey. From the initial conversation, MyChoice Home Loans offer convenience, choice and clear information and communication, giving you peace of mind throughout the entire build journey.

They work towards getting your loan approved faster and continue to provide support throughout the entire life of your loan, so that you can feel confident and relaxed knowing your finances are taken care of.

Can My Partner Get the First Home Buyer Grant in QLD?

In cases involving couples or joint applicants, eligibility extends to both partners if neither has previously owned a home. This means it’s easier than ever for couples to buy their first property together.

Application Process

First-time homebuyers can apply for the grant by following a simple step-by-step application process available through the Queensland Revenue Office (QRO). First you will need to check the eligibility criteria, and it’s also recommended you go through their eligibility tester to save you some time in case you aren’t eligible for the grant.

If you are indeed eligible, you can apply in one of two ways: through an approved agent like a bank or other lending institution, or directly to the QRO. The former is a much faster way to get your application processed, as approved agents can confirm your eligibility and manage your application while you focus on saving money for your deposit.

If you would prefer to apply directly online, you will need to follow the outlined steps and provide all supporting documentation. Remember that the grant isn’t paid out until the home is completed.

What Other Incentives Am I Eligible for in QLD?

In addition to the expanded First Home Owners Grant, you may also be eligible for a range of other government grants to help cover the costs of building your dream home:

1. QLD First Home Vacant Land Concession

For those who plan on building a new home on vacant land, Queensland has a First Home Vacant Land Concession. This can deliver potential savings on purchase and construction costs, but first you will need to determine your eligibility.

2. Family Home Guarantee

Introduced in 2021, the Family Home Guarantee is a targeted scheme that aims to support single parents in their buying or building journey.

Brighton Homes: Paving the Way to Homeownership for First-Time Buyers

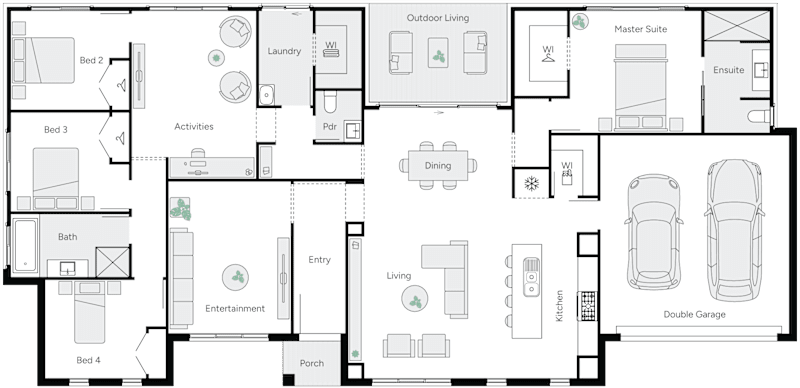

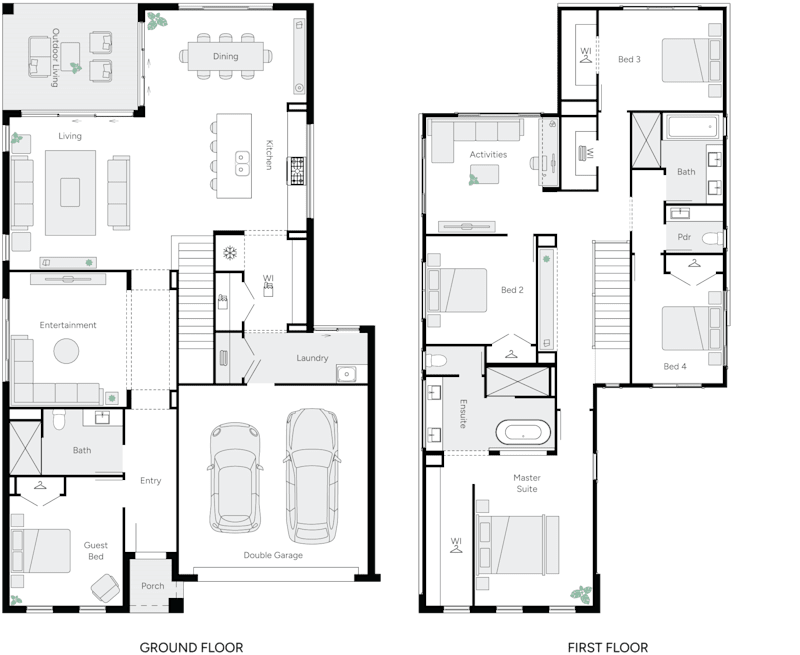

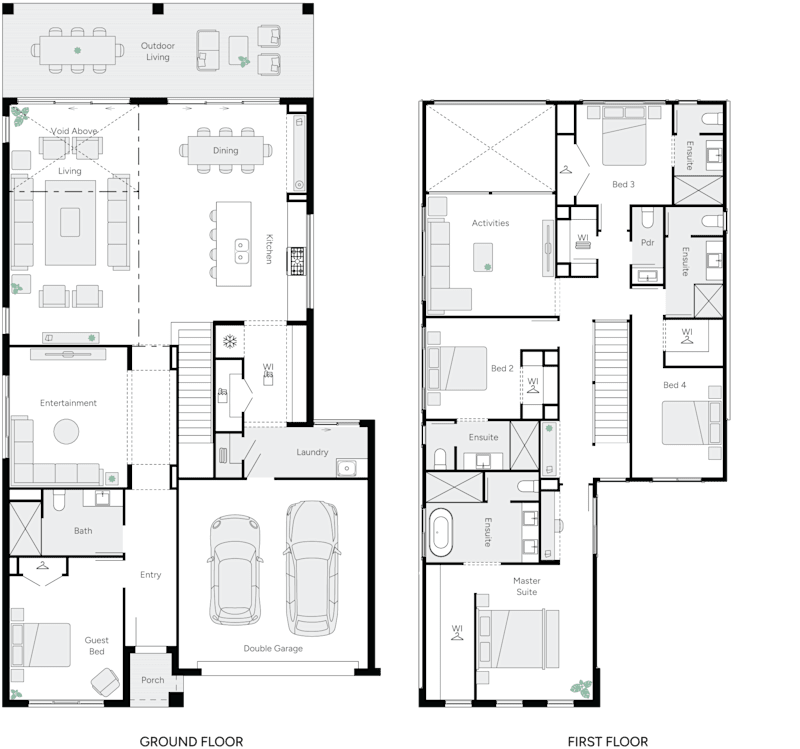

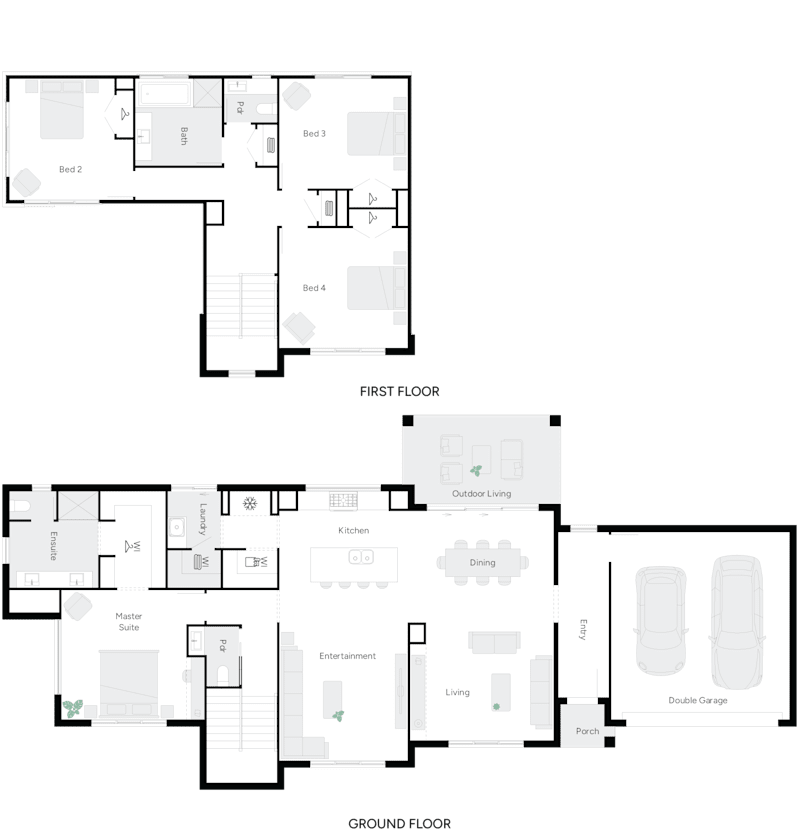

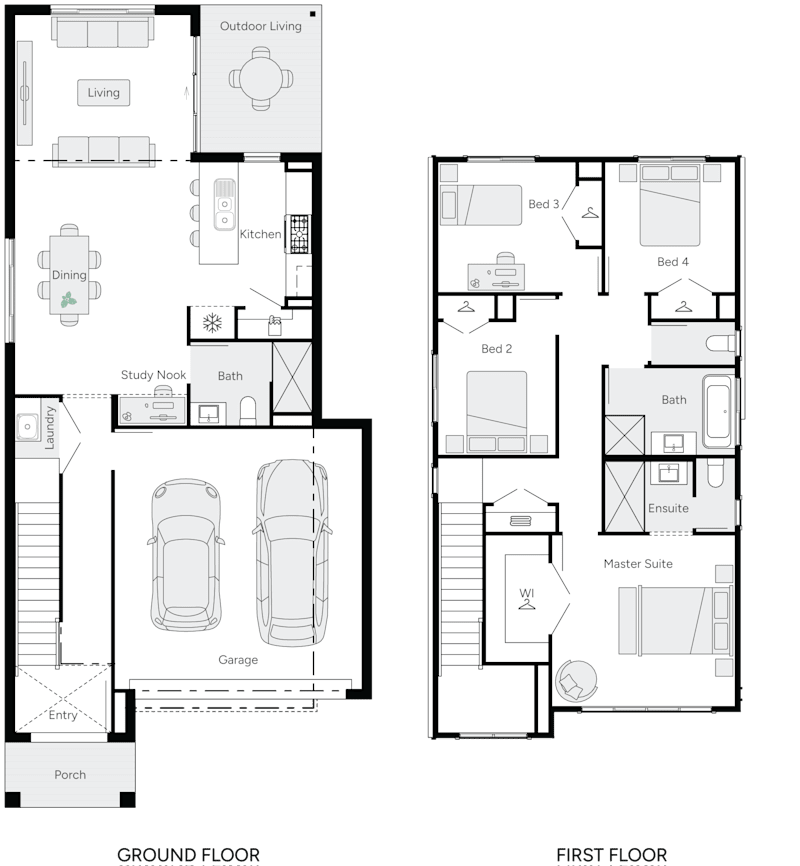

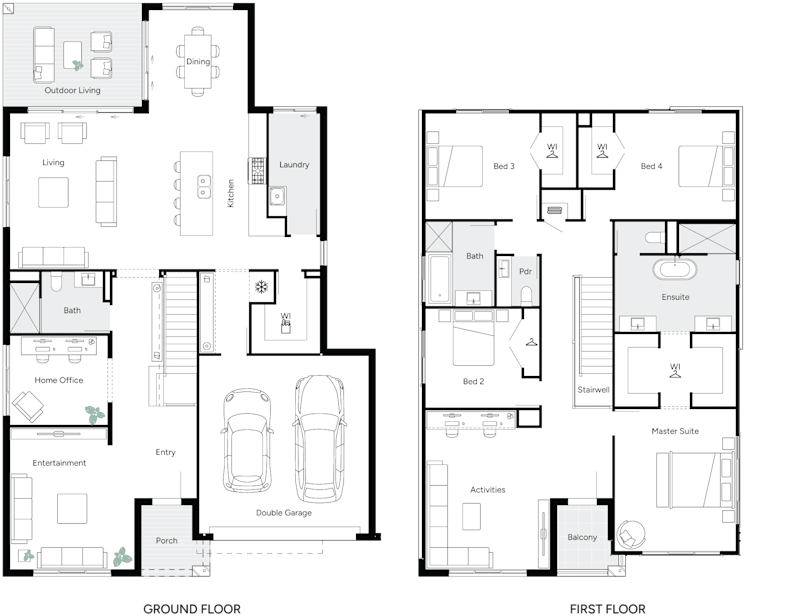

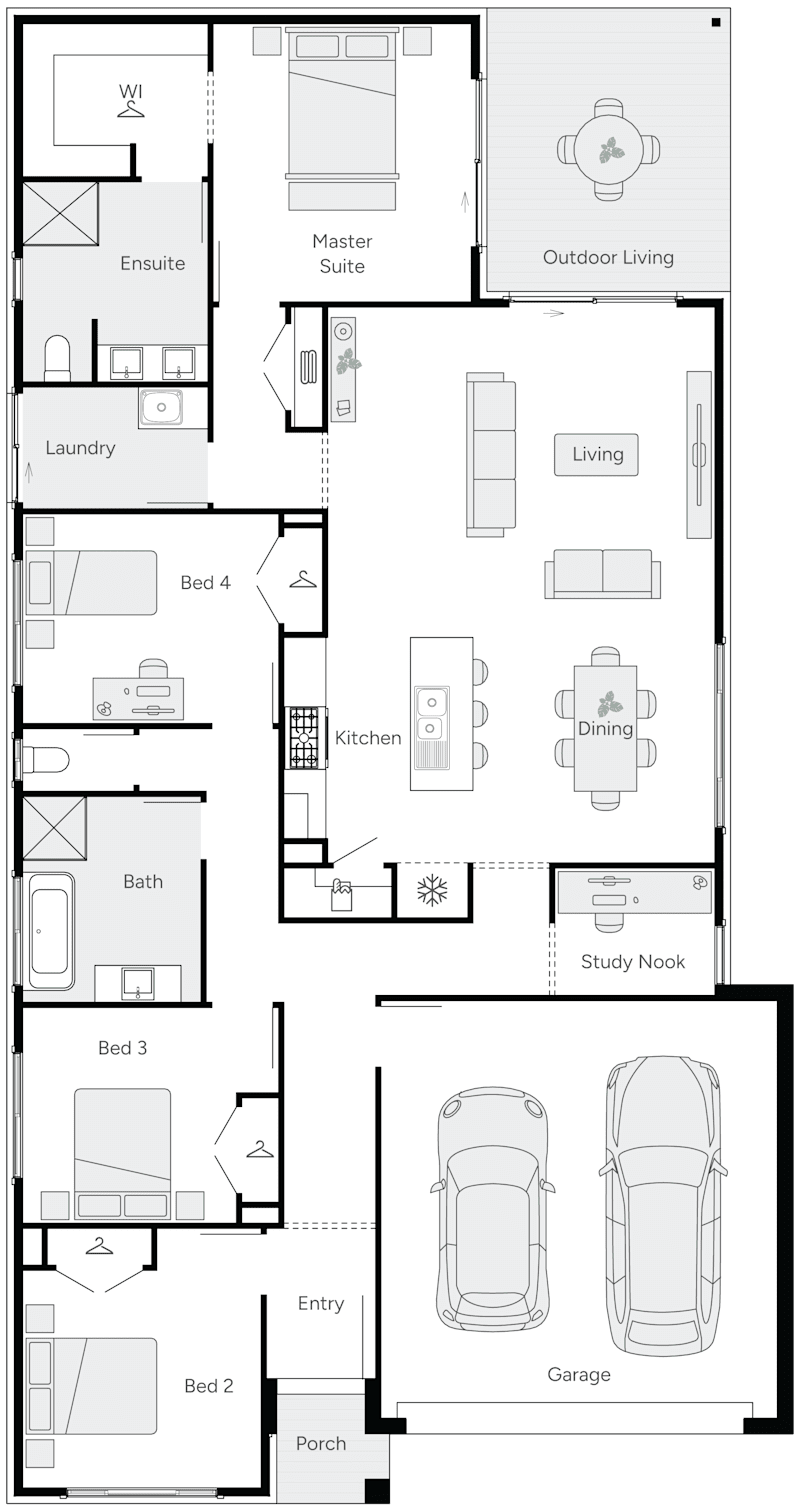

At Brighton Homes, we're excited about the increased First Home Owner Grant and are committed to helping new home owners achieve their goals – whether you’re dreaming of a Gold Coast lifestyle, want to start a family in Brisbane or anything in between. With our wealth of experience, helpful tips for how to save and get your first home faster, and wide range of home designs, we’re here to support every home buyer.

Explore our home designs or reach out for more information about how you can take advantage of the First Home Owner Grant.